Institutional-Quality Private Real Estate

Timberland Partners sponsors single-, and multi-asset apartment funds for accredited investors to invest in high-quality real estate assets. We aim to provide investors with strong risk-adjusted returns by executing a refined and disciplined value-add investment strategy.

Our Investment Strategy

We Target:

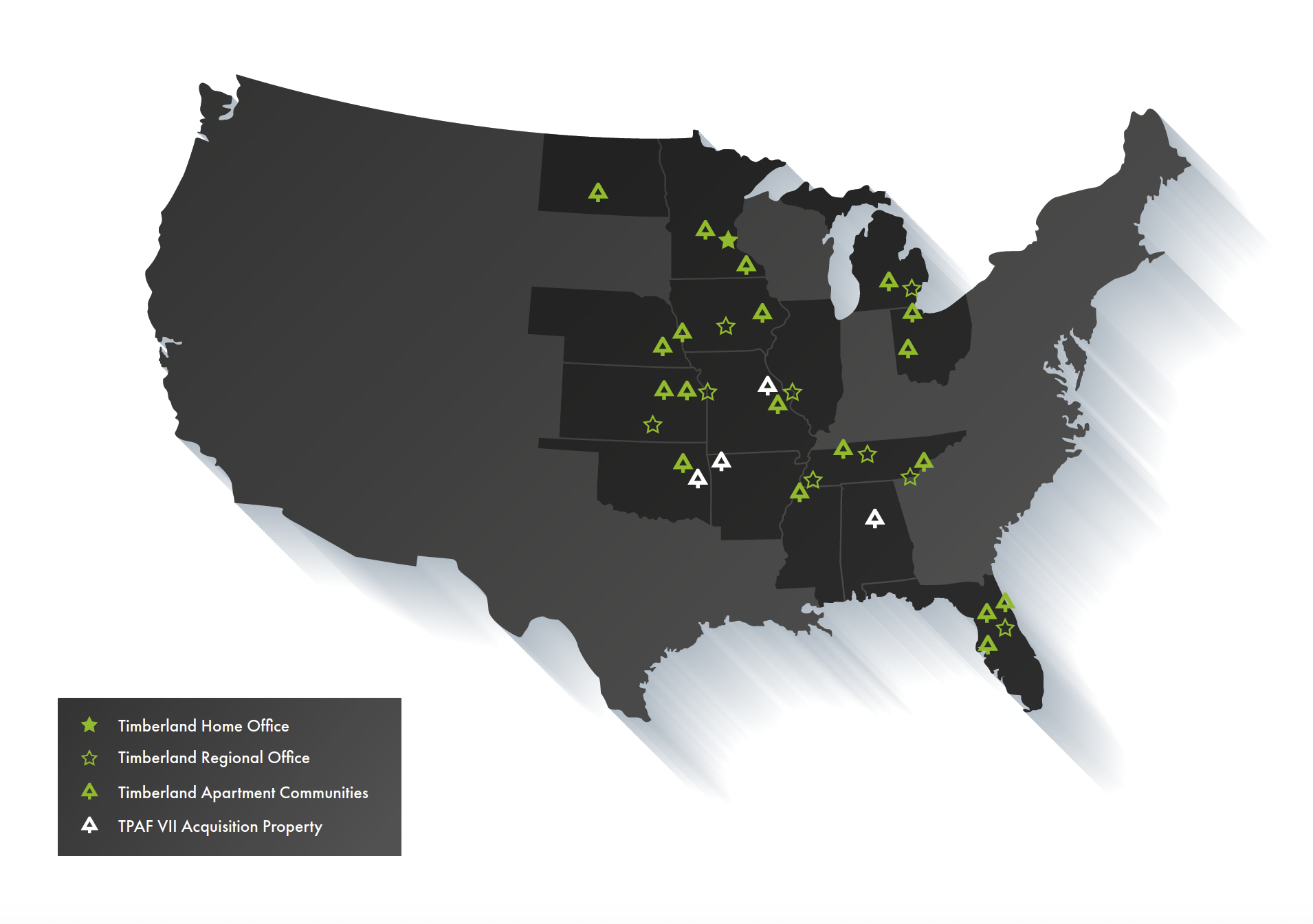

Garden-style apartment communities in suburban areas of secondary and tertiary markets in the central and southeastern US

Properties where we can add value through strategic capital improvements and/or improved operational efficiencies

In-house property management on a national scale to drive portfolio-wide operational savings

Units

Properties

States

Billion Market Value

Interested in Investing with Timberland Partners?

Reach out to a member of our investor relations team today to start the conversation.