Sign up for our newsletter >

Sign up for our newsletter >

As a vertically integrated company, our in-house property management team manages all properties in the portfolio. This integrated platform has direct positive benefits for our investment partners:

Our expert team is highly experienced in acquiring established assets, and providing new housing options to communities in need of supply.

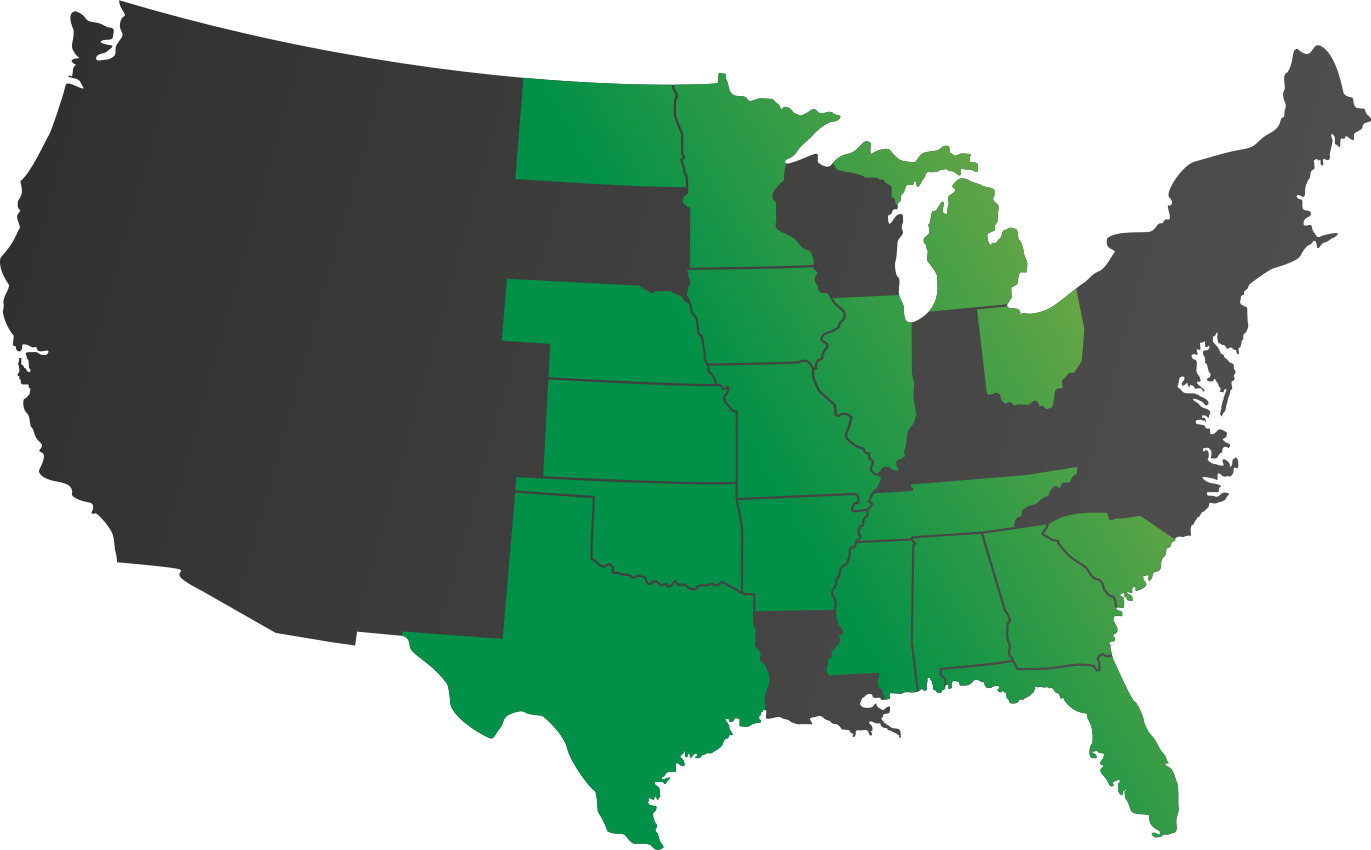

Identifying undiscovered potential in emerging or underserved markets is our specialty. Our detailed knowledge of apartment markets across the country allows us to capitalize on opportunities to reposition properties, to

better align with market needs.

From conception through stabilization, delivering outstanding apartment communities is our mandate. From site selection through design, financing, construction, and lease-up, our highly experienced development team

delivers exceptional results.

Build your portfolio with opportunities positioned for consistent income generation and long-term capital appreciation.

Financial Criteria

For further specifications please refer to the SEC website

Subscribe to receive the latest news and insights from our team, event invitations, and opportunities to invest.