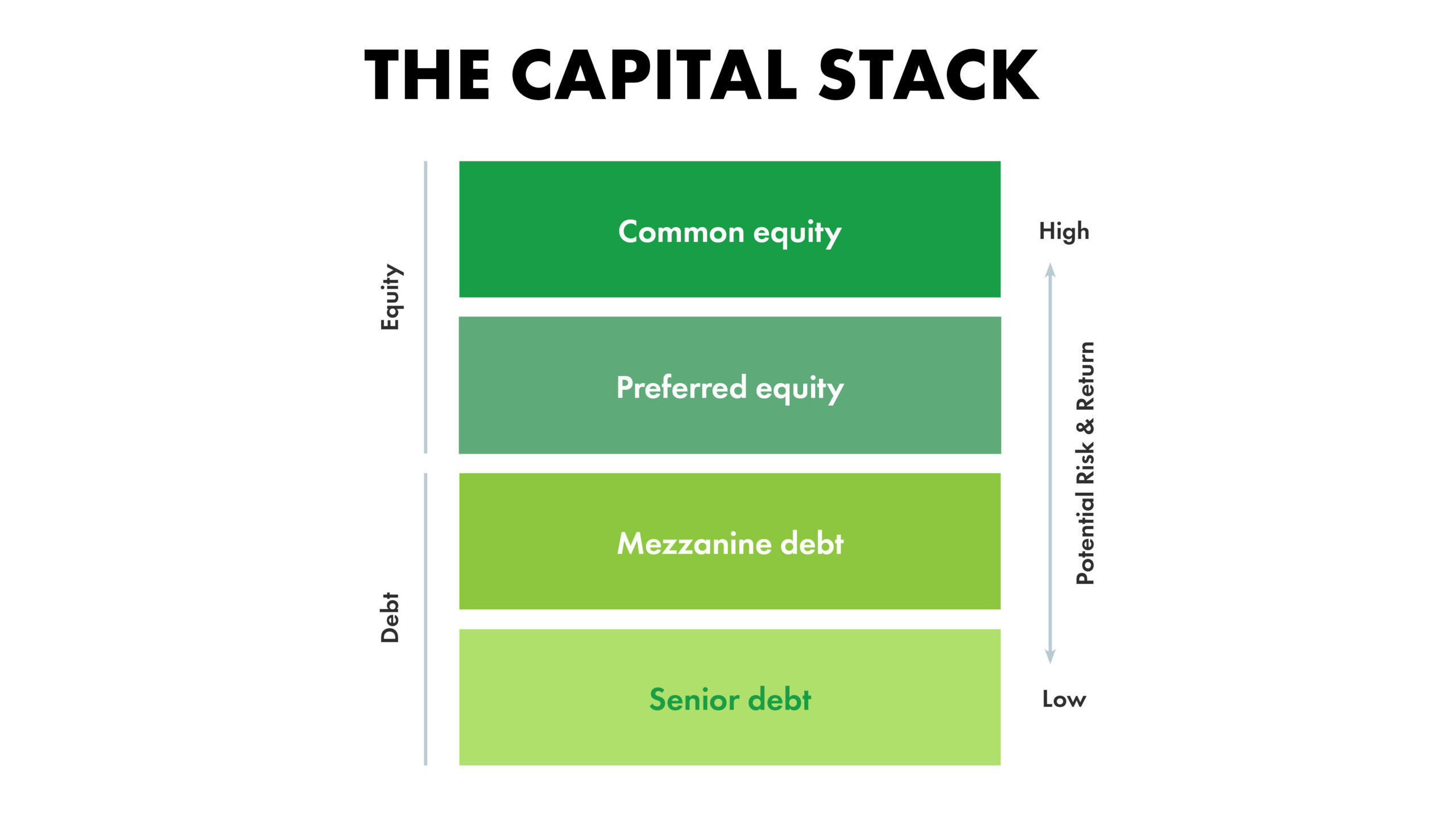

The capital stack is the layered structure of financing sources that funds property acquisitions and refinancing, such as for a multifamily apartment building. Each layer of capital has a different risk, return, and repayment priority profile. Multifamily investors structure the capital stack to increase investor returns through leverage, while controlling potential losses and optimizing for long-term tax implications. By using leverage (a loan) to cover a large portion of the purchase price, the initial cash required from the investor is much smaller and ideally, increasing the percentage return on that cash.

The Safest Layer of the Capital Stack

The least risky layer of the capital stack is senior debt, which can also be thought of as a mortgage. In multifamily deals, senior debt typically comprises 60-80% of the total capital. It is the lowest cost layer and has first claim on assets in case of default. Several types of lenders provide senior debt for multifamily acquisitions and refinancing, such as banks, life insurance companies, commercial mortgage-backed security (CMBS) lenders, and debt funds. For experienced multifamily investors, Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac are a reliable source of capital offering favorable terms. GSEs have a congressional mandate to provide liquidity and stability to the U.S. housing market. GSE loans are typically non-recourse, meaning if the borrower defaults, risk is isolated to the specific asset. It cannot pursue the sponsor’s other personal or business assets. These loans may also come with an “interest-only (IO)” period, during which the sponsor only pays interest, not principal. This period, which can be 3, 5, or even 10 years, increases cash flow in the early years of the investment. Most GSE loans are assumable, meaning a future buyer can take over the seller’s existing loan, a highly attractive feature if interest rates have risen. There are many other benefits, and GSEs are the senior debt source Timberland Partners typically finds most favorable for our business plan. Timberland Partners is a “preferred borrower” with both Fannie Mae and Freddie Mac, a designation that reflects the firm’s strong financials, management experience, track record, and compliance. As a preferred borrower, the firm may be allowed lower interest rates, higher loan proceeds, and expedited processing compared to other borrowers.

Risk and Rewards of Common Equity

The riskiest layer is the common equity, or the cash invested by the limited partner and general partner investors. If the property’s value drops, the equity value is the first to be reduced. However, the common equity holders capture all of the upside after the debt payment obligations are met. The general partner typically controls the deal and is responsible for executing the business plan. This includes managing the property’s leasing operations, overseeing improvements, and deciding when to sell or refinance. Timberland Partners’ principals – the Fransen family – and other senior management, typically invest 15-20% of the equity required for an acquisition. This is significantly higher than the 5-10% contribution from many sponsors. When the general partners invest a large amount of their own capital in the same common equity as their limited partners, they are directly exposed to the same risk.

Why Timberland Partners Avoids Gap Financing

In between debt and equity are layers of “gap financing” such as mezzanine debt and preferred equity. These layers are riskier than senior debt and carry higher interest rates to compensate for this higher risk. While these types of financing can help a company grow, they also introduce more risk for the investors. Timberland Partners adheres to a more risk-averse strategy. As of mid-2025, our overall portfolio leverage is in the mid-50% range. The firm has historically not used mezzanine debt and preferred equity in our investments. A well-structured capital stack is crucial for both growing and protecting investor capital. Our conservative approach to leverage allows us to withstand market fluctuations and supports long-term performance.

To learn more about how our investments are structured to protect and grow investor capital, schedule a call with our team.