“Why is renting in Minneapolis so much more affordable than buying right now?” That was the title of an April 2025 CBS News feature on the rent-versus-buy question and the growing premium to purchase a home in Minnesota and across the country. The article goes on to state that nearly 30 percent of Minnesotans live in a rental unit, tracking closely to the 34 percent national average. Another article from CNBC shares that in at least 13 major U.S. cities, owning a home requires twice the income needed to rent. Across the country, rising home prices coupled with higher interest rates has made homeownership increasingly expensive. The result for multifamily properties? Stronger demand and tenants staying longer. As the recent supply surge abates, these demand drivers will set the stage for the resurgence of steady rent growth.

Affordable For-Sale Housing Shortage

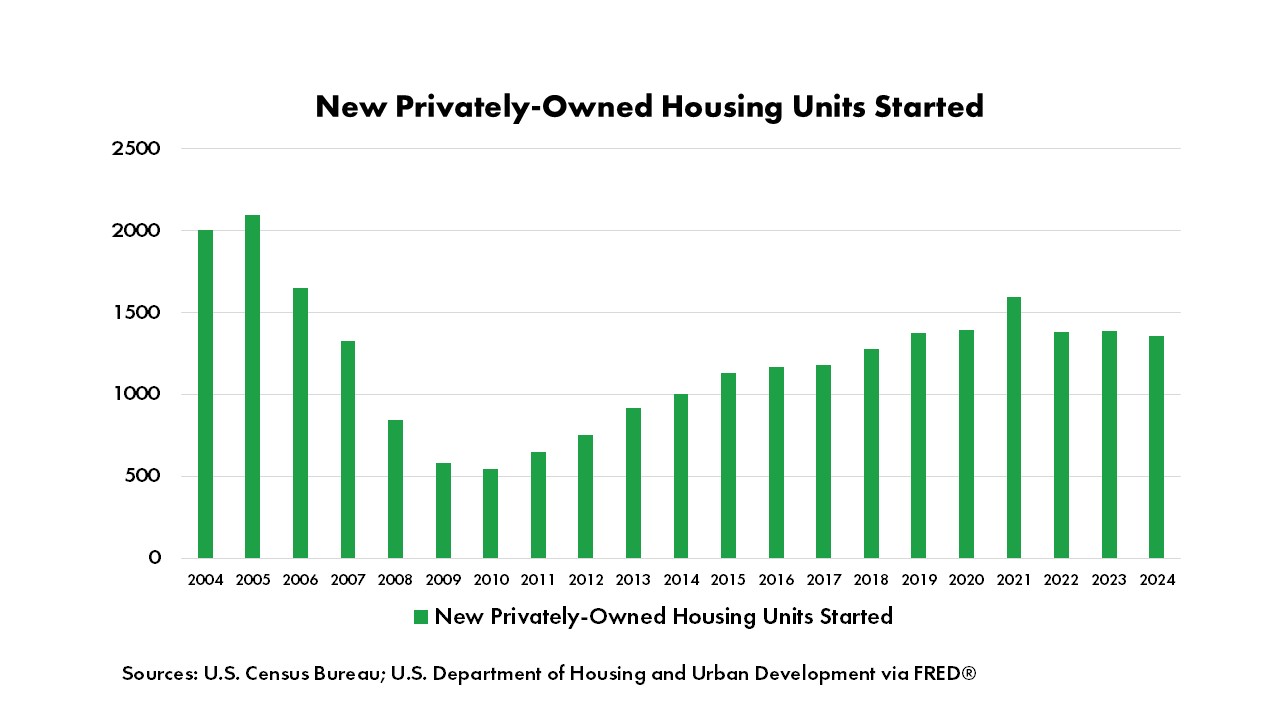

The shortage of affordable housing in the United States is not a new issue. There is not enough housing supply to meet demand, with the supply of homes for sale reaching a record low of 1.6 months (the measurement of housing supply) in January 2022, according to NAR. Typically, 5 to 6 months of housing supply indicates a balanced market that favors neither buyers nor sellers. The Great Recession’s impact on new home construction is still being felt today. After peaking in January 2006 with more than 2,200 housing units started, starts hit a low of just 478 in April 2009. Numbers have yet to recover to pre-Great Recession levels. The shortage is especially severe for low and middle-income renters, where wages have lagged increases in cost of living.

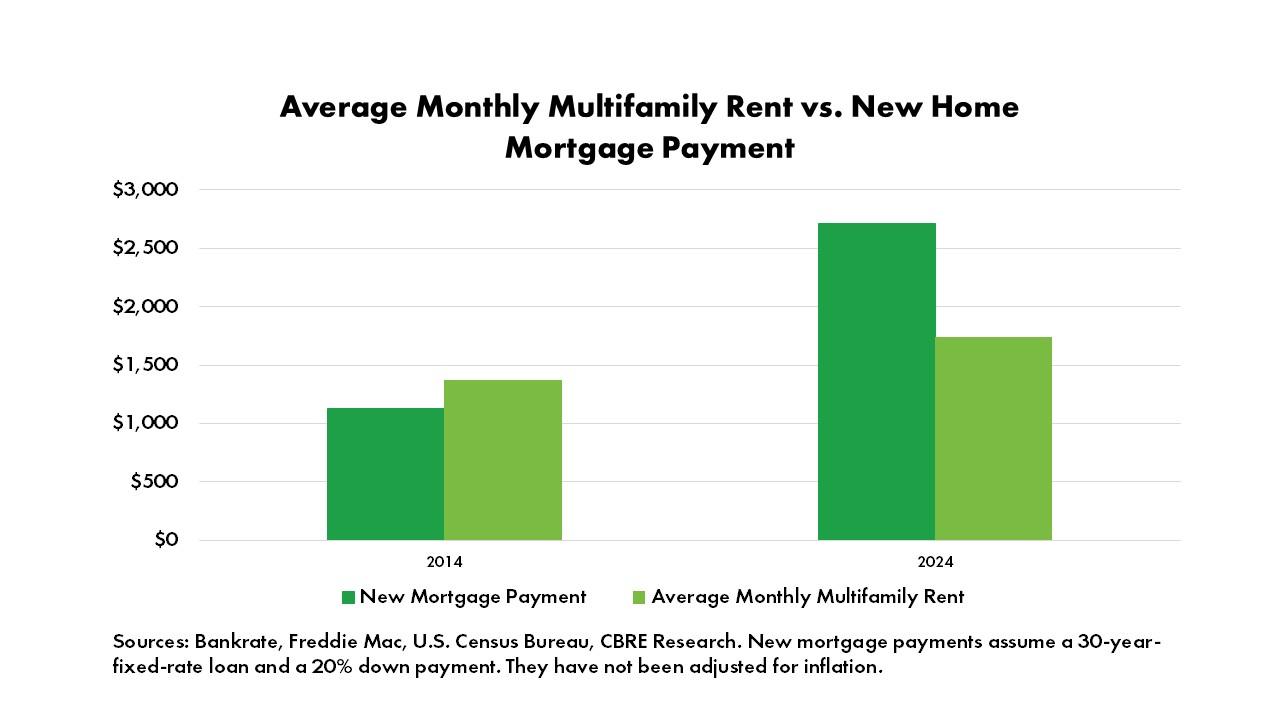

Rising Mortgage Rates

The high-interest rate environment since the second half of 2022 has complicated matters, impacting for-sale supply and creating a growing difference between the cost of renting and a mortgage. With rates over 6 or 7 percent, many aspiring home buyers paused their searches. Sellers were extraordinarily deterred from selling – locked into their low rates and accompanying monthly payments. Most homeowners are not looking to double their mortgage payments, but that would be the scenario for many. As measured in the second quarter of 2024, more than half of outstanding mortgages have a rate of 4% or lower. For most homeowners, this means staying in their current home, even if it’s no longer fitting their lifestyle needs. Until rates decrease significantly, it is unlikely that housing supply will reach pre-pandemic levels. It is currently cheaper to rent a home than pay a mortgage in all 50 of the largest U.S. metros in 2025. The average monthly mortgage payment for a median-priced home ($425,583) in the United States including taxes and insurance, was $2,768 as of February 2025 per Redfin. The average national monthly rent is about $2,000. In major West Coast metros, the gap is substantially larger, with San Francisco topping the chart, where the typically monthly mortgage payment of $8,882 is 190.7% higher than the typically monthly rent of $3,055.

Cost of Construction

Building more housing is a key part to closing the housing gap, but the outlook isn’t promising. Recent tariff discussions spiked prices of lumber, a key construction input which comes mostly from Canada. Higher material costs, lengthy permitting processing, construction labor shortages, and restrictive zoning have kept demand for housing well ahead of the current pace of construction. On average, it takes 18 months to build an apartment building, with delays often attributed to permitting issues. There is a massive labor shortfall in the construction industry. According to the Associated General Contractors of America, 66% of construction firms report project delays due to labor shortages. This shortage can be attributed to an aging workforce and shrinking pipeline of new workers. Zoning and NIMBY activists often create huge obstacles to building higher-density housing like apartment buildings. Recent innovations such as modular housing are being touted as a potential solution to reduce construction costs.

High Demand for Rental Housing

The latest data from the first quarter of 2025 suggests strong renter demand. The overall multifamily vacancy rate dropped to 4.8%, as over 100,000 units were absorbed. This represents a 77% year-over-year increase and the highest Q1 absorption since 2000. While most markets typically record very low or negative net absorption in Q1, sixty-three of the 69 markets tracked by CBRE recorded positive net absorption. Low inventory, population and household formation growth, and lifestyle preferences are all driving strong demand.

Sources

“Minneapolis Rent, Home Ownership Cost Gap.” CBS News, 3 June 2025, www.cbsnews.com/minnesota/news/minneapolis-rent-home-ownership-cost-gap/.

“The Mortgage-Rent Divide: A Look at the Growing Gap.” RealPage Analytics, 3 June 2025, www.realpage.com/analytics/mortgage-rent-divide/.

“Why More Americans Are Opting for Rental Properties Over Homeownership: CBRE.” CBRE, 3 June 2025, www.cbre.com/press-releases/why-more-americans-are-opting-for-rental-properties-over-homeownership-cbre.

“Housing Affordability: Purchase Costs Over $1K More Per Month Than Renting Similar Home.” JBREC Insights, 3 June 2025, jbrec.com/insights/housing-affordability-purchase-costs-over-1k-more-per-month-than-renting-similar-home/.

“U.S. Cities Where Owning a Home Requires Double the Income of Renting.” CNBC, 4 May 2025, www.cnbc.com/2025/05/04/us-cities-where-owning-a-home-requires-double-the-income-of-renting.html.

“Renter Households Increasingly Cost-Burdened, Especially for Certain Racial and Ethnic Groups.” U.S. Census Bureau, 3 June 2025, www.census.gov/newsroom/press-releases/2024/renter-households-cost-burdened-race.html.

“Housing Starts: Total: New Privately Owned Housing Units Started.” FRED Economic Data, Federal Reserve Bank of St. Louis, 3 June 2025, fred.stlouisfed.org/series/HOUST.

“Housing Shortage: The Supply Gap Continues to Widen.” Realtor.com, 3 June 2025, www.realtor.com/news/trends/housing-shortage-supply-gap-data/.

“Skilled Labor Shortages in Construction.” Travelers, 3 June 2025, www.travelers.com/resources/business-industries/construction/skilled-labor-shortages.