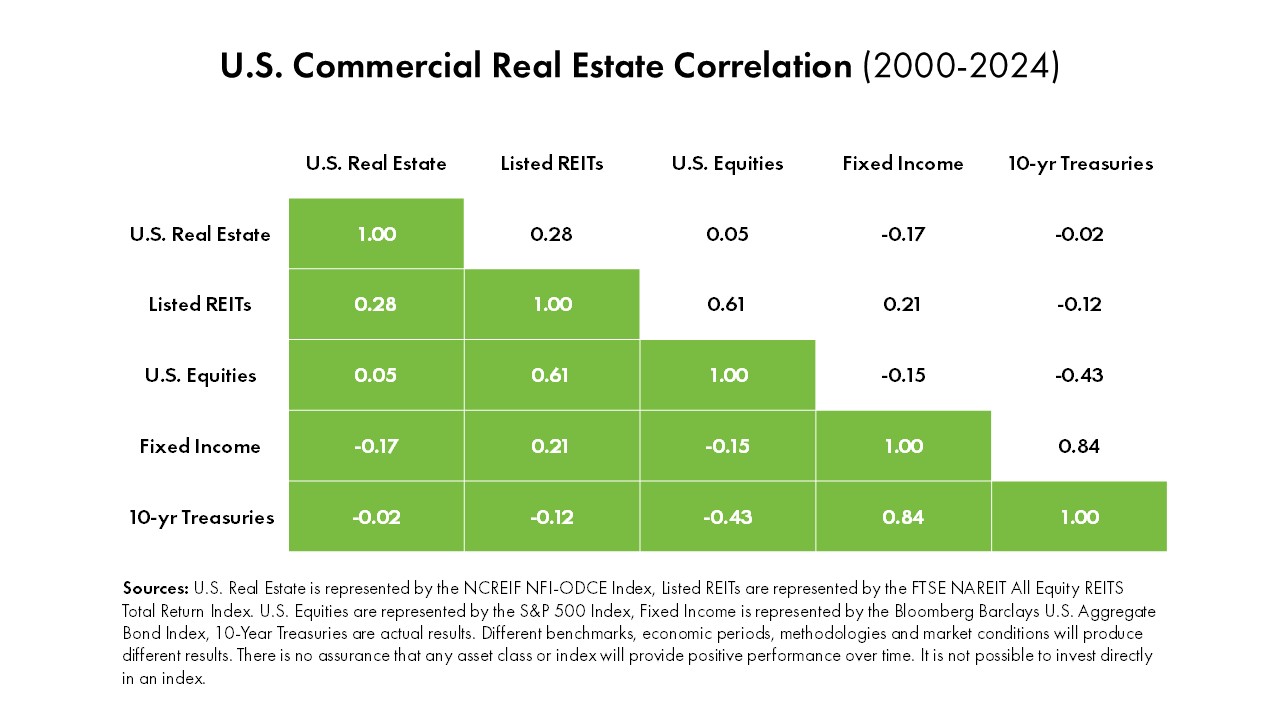

Real estate continues serve as a compelling addition to investor portfolios – with the potential both to reduce overall volatility and enhance return performance. Factors such as population growth, economic development, and inflation have historically contributed to real estate values increasing over time. Additionally, many investment properties generate a steady stream of income for investors. Since real estate often has a low correlation with common stocks and bonds, it can help diversify portfolios and reduce overall risk. Real Estate Investment Trusts (REITs) and private real estate investments are two passive strategies to add exposure to the real estate market. Over the last 20-year period, both have delivered strong returns, but they differ in their structure, accessibility, liquidity, and historical volatility. For institutional investors and high-net-worth individuals, both REITs and private real estate can contribute to enhancing a traditional portfolio of stocks and bonds.

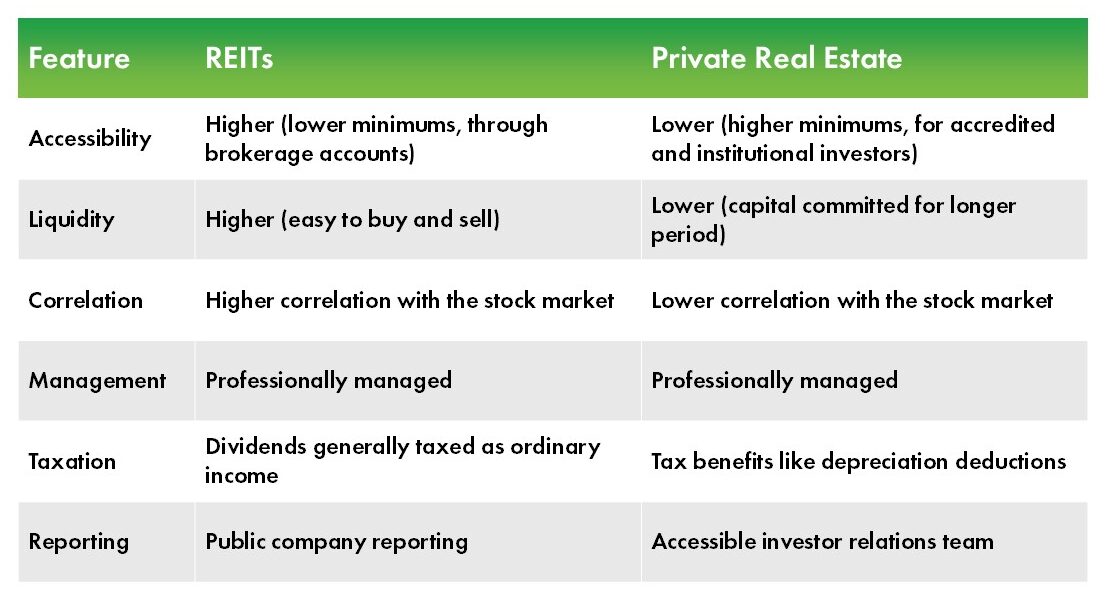

Key Differences Between REITs and Private Real Estate

Publicly traded REITs are companies that own, operate, or finance income-producing real estate, typically consisting of large property portfolios. They may include multiple property types such as apartments, shopping centers, office buildings, hotels, and warehouses, or specialize in one sector. Public REITs are highly accessible, since they are listed on major stock exchanges alongside common stocks and accessible through a brokerage account. Shares can be bought and sold quickly on the exchanges and the high frequency of trading makes REIT stocks a highly liquid investment. According to NAREIT, approximately 170 million Americans invest in REITs through their 401(k), pension plans, and other investments.

Private real estate investments are typically pooled vehicles in which a group of investors contribute capital to acquire an individual property or a portfolio of properties, and are typically structured as partnerships or LLCs. Like REITs, private real estate vehicles may include multiple property types or specialize in one sector. However, due to their lower liquidity and lighter regulatory requirements, they are often restricted to accredited or institutional investors. Accredited investors are defined as meeting specific income or net worth requirements as defined by the SEC. Investors in private real estate typically commit capital for longer periods of time and with limitations on redemption options.

To qualify as a REIT, a company must satisfy certain requirements relating to organizational structure, ownership, and income. A key aspect is that REITs must legally distribute at least 90% of its’ taxable income to shareholders as dividends. However, depreciation is taken at the REIT level and most dividends are taxed as ordinary income at the investor’s marginal income tax rate. In contrast, investors in private real estate pay tax on their allocated share of the net income from the partnership – not on the distributions or “dividends” themselves. This is possible because the vehicles are typically “pass-through” entities such as partnerships or LLCs, where depreciation flows through to the investor level, reducing taxable income.

Comparing Historical Performance

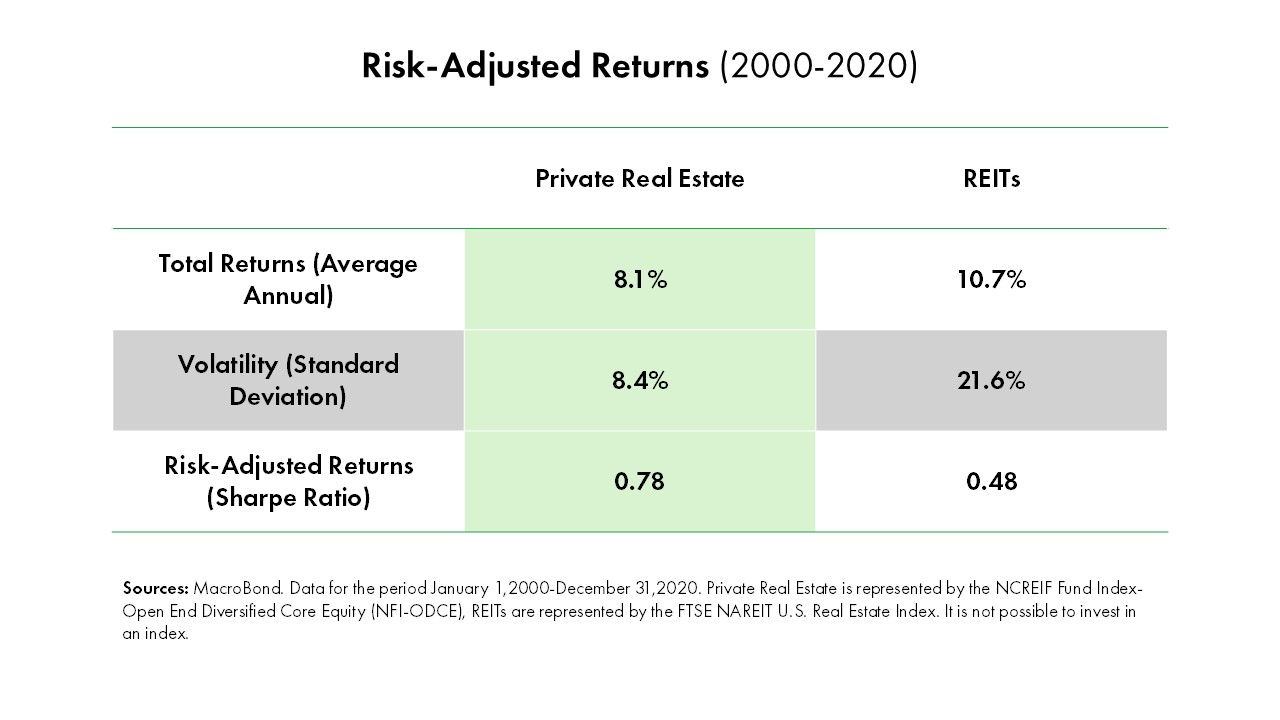

When comparing the FTSE NAREIT All Equity REITs Index and the NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE) – the benchmark for Private Real Estate – REITs generally delivered slightly higher returns on an absolute return basis over a 20-year period, typically 1-2% higher depending on years included. However, NFI-ODCE consists of low-leverage core assets, and many private investment vehicles have far exceeded these returns.

Public REITs and private real estate investments behave most differently in regard to volatility and correlation. Since public REITs are traded on stock exchanges, they are susceptible to market sentiment and broad economic news, leading to more significant pricing volatility. Public REIT stocks are also more correlated to broader stock market indices such as the S&P 500 and may not offer the same diversification benefits as private real estate during equity market downturns. From 2000-2020, REITs displayed a volatility standard deviation of 21.6%, whereas private real estate was measured at 8.4%. For investors seeking to reduce overall portfolio risk, the volatility smoothing and lower correlation with stocks is one of the most attractive features of private real estate.